Law change stokes competition for NHS contracts

Over the last seven years the private sector has developed a more significant role in providing NHS services because they have been able to bid for a huge range of NHS contracts.

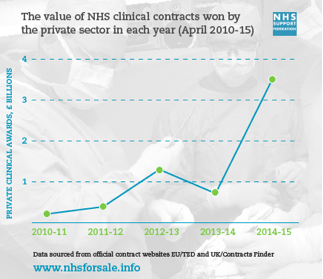

The passing of the Health and Social Care Act in 2012 enforced competition between the NHS, private firms and charities. The impact was immediate. Research by the Federation showed that the value of contracts won by the private sector rose by 500% In the two years after the new law came in to effect.

New private sector growth in the NHS

Despite government claims of “no privatisation” in the NHS, billions of pounds are going to private companies to run NHS clinical services. Virgin Care were the biggest private sector winner over 2016/17 collecting over £1bn in NHS clinical contracts.

Private companies winning a bigger share

For-profit companies won £2.2 billion worth of new contracts in 2017/18 - 42% of the total value of awards advertised.

Overall, private firms won 267 awards - almost 70% - of the 386 clinical contracts that were put out to tender in England during 2016/17. They included the seven highest value contracts, worth £2.43 billion between them. The private sector beat the NHS to 13 of the 20 highest value awards.

Catalogue of failures from outsourcing NHS care

Our report details the catalogue of failures, with dozens of examples since 2012. Private firms have taken over NHS services but then abandoned contracts for a variety of reasons:

- the contracts cost them too much

- they could not recruit enough staff

- they went into administration

- or, often, because of serious complaints about the quality of their service.

Coperforma was forced to give up the £63m contract to provide ambulance services in Sussex after the service fell into chaos leaving patients stranded and missing appointments.

Primecare was rated "inadequate" by the Care Quality Commission. In September 2017 they announced they would be handing back a contract to provide NHS 111 and GP out-of-hours services contracts.

Vanguard Healthcare left dozens of people with impaired vision, pain and discomfort after undergoing operations provided under their contract with Musgrove Park Hospital, Taunton.

Circle pulled out of its 10-year contract to run Hinchingbrooke hospital in Cambridgeshire – the first NHS hospital to be run by a private firm – after financial problems and heavy criticism from the Care Quality Commission.

Health Secretary denies big rise in funds to privateers

In May 2018, former Health Secretary (Jeremy Hunt) told a parliamentary committee that spending on private providers was not huge, despite it almost doubling since 2010.

A survey of local NHS commissioners by the NHS Support Federation shows that they now spend an average of 15% of their operating expenses on employing private companies and charities to deliver healthcare. 10 CCGs spent over 25% of their budget.

These figures are higher than the 11% figure shown in the national accounts - which expresses the spendin gon non-NHS organisations as a % of the overall DEL (Departmental Expenditure Limit).

Local commissioners spend most of their budget organising healthcare whereas the national budget also pays for all administration and nonclinical functions.

The scale of private sector involvement in the NHS is regularly downplayed in departmental and ministerial statements. However, the Health and Social Care Act has ensured that non-NHS providers have been able to establish and substantial foothold in local NHS provision.

Just as opponents to the Act had predicted it stoked the market and forced open many more NHS contracts for private firms and charities to bid for. In the following years £25 billion worth of opportunities to plan and deliver NHS care have been advertised.

Virgin Care has won deals worth over £1 billion since 2010. Other prominent companies, such as Care UK, Circle, InHealth, Lloyds Pharmacy and Boots, have also built up large portfolios of NHS contracts. Third sector organisations (charities and community interest companies) have also gained a small share of the work available; since April 2013 £396 million (7% of contracts) has been won by such groups.

Private providers are gaining a strong foothold - 10 CCGs spent over 25% of their operating budget on non-NHS providers, the average is 15%.