Over the last decade the private sector has been given a chance to run a far greater range of NHS services, and now, in particular in areas like mental health and diagnostics, the NHS is heavily reliant on its capacity.

After a catalogue of controversial failures and the realisation that integration in care is incompatible with a competitive market in the NHS, NHS leaders finally demanded a change in policy direction. The Health and Care Act 2022 abolished legislation that enforced competition.

In reality, however it looks unlikely that the private sector's strong foothold within the NHS will disappear any time soon.

Seven reasons why this is not the end of the NHS privatisation story

1. Outsourcing has increased during the pandemic

The years of the Covid-19 pandemic (2020-2023) has shown us just how willing the government is to give contracts to private companies, even if they are not well equipped to do the work. Examples include the allocation of £37 billion to the test and trace system, much of which is likely to have been spent in contracts with private companies, and the millions spent on using the capacity of private hospitals. NHS England’s ‘Delivery Plan,’ which is supposed to enable the recovery of acute services from the after-effects of the pandemic, is heavily focused on the need for long-term reliance on the “capacity” of the private sector. In mid-2021 the government announced the NHS Increasing Capacity Framework contract which is valued at £10 billion over four years. This framework contract creates a list of independent providers that can be asked to carry out NHS work and is part of the government's plan to tackle the waiting list for elective procedures. In July 2021, a multi-year framework agreement was advertised by NHS England seeking companies/organisations to provide services at around 150 planned new community diagnostic hubs.

2. Outsourcing will continue despite new legislation

Legislation to remove the much criticised competition rules, which allow commercial companies to bid for a vast array of NHS contracts and were a keystone of the Tory health reforms of 2012, has now passed through Parliament. However, NHS England’s elective recovery plan places heavy reliance upon on the use of the private sector, and the lack of investment in NHS staffing makes further outsourcing inevitable. Also the reality is that the private sector has already won over £20bn in contracts throughout the competition era, according to figures from the NHS Support Federation, and there is no sign of these contracts being transferred back into the NHS.

The removal of the flawed competition rules is a welcome shift and some reward for years of public campaigning but it does not yet translate into full protection for NHS services from privatisation, or mean that ministers are fully backing a plan to raise NHS capacity so that it can handle demand and take back control of the supply of public healthcare.

3. Firms believe that there is a big role for them in the NHS

Over the years companies have won NHS contracts that are worth hundreds of millions of pounds. Companies, such as Virgin Care (now HCRG Care), Practice Plus Group, Spire, Alliance Medical, Cygnet Healthcare, The Priory Group, all receive millions each year from the NHS for services. Indeed, many companies, in particular those in mental health, are totally reliant on NHS contracts. Although NHS England is trying to leave the competition era behind, with a new agenda centred around the theme of integration, this shift does not appear to have disrupted the business strategies of the prominent privateers.

The Health and Care Bill proceeding through Parliament could mean that contracting out of community health services might stop, which would affect some firms, but it is unlikely to have much impact on the big money contracts – mental health, elective care and diagnostic services where the NHS lacks sufficient in-house capacity.

Tim Read of the US-based Marwood Group has commented “Ultimately, the independent sector is heavily enmeshed into the fabric of service delivery…in mental health any reduction in the use of private sector high-acuity services would first require significant investment in the NHS mental health estate” .

In elective care, NHS commissioners are being asked to make more use of the private sector and the new boom area is in-sourcing whereby private companies conduct NHS-funded operations within NHS premises (see below for details).

ONE QUARTER

of NHS hip replacements are carried out by the private sector

SOURCE: NATIONAL JOINT REGISTRY

ONE THIRD

of NHS knee replacements are performed by private providers

SOURCE: NATIONAL JOINT REGISTRY

4. The NHS has become more reliant on the private sector capacity and the NHS isn't expanding its own

The NHS is becoming more dependent on the private providers as its own capacity comes under greater strain. The most recent figures available show that for 2019 the independent sector carried out 32.9% of NHS-funded knee replacement procedures and 28.9% of NHS-funded hip replacement procedures.

According to NHS Partners network, which represents non-NHS health organisations, in 2020, 21% of all gastroenterology, trauma and orthopaedic NHS patients are treated by independent providers (both private and not-for-profit) and 250,000 CT scans were carried out within NHS contracts. Prior to the Covid-19 pandemic, the organisation says that over 500,000 non-urgent operations and surgical procedures were carried out by private clinicians for the NHS in 2018, about 6% of the total.

Waiting times are rising to the point that those that can afford it are seeking help from private providers. By April 2023, the waiting list for elective surgery had risen to its highest level ever at 7.4 million. Spire, a leading private hospital chain, reported exceptionally strong growth in self-pay in 2021 and 2022, with revenue up 63.3% from 2019 pre-pandemic levels to 2021, then another 14.5% up in 2022. However, most patients cannot afford these fees. NHS leaders have instructed local managers to make greater use of the private sector, buying operations for NHS patients.

The capacity problem is particularly bad in the area of mental health services. NHS mental health bed numbers have fallen from 23,515 in April 2011 to 18,029 by March 2023. This reduction in NHS capacity has meant that the NHS has been forced to turn to the private sector. In 2020 the private sector had just over 9,000 beds, the majority of which are used by the NHS, under contract. The income of one of the leading companies in the sector, Cygnet Healthcare, is entirely from NHS contracts and most companies in the sector gain the majority of their income from the NHS.

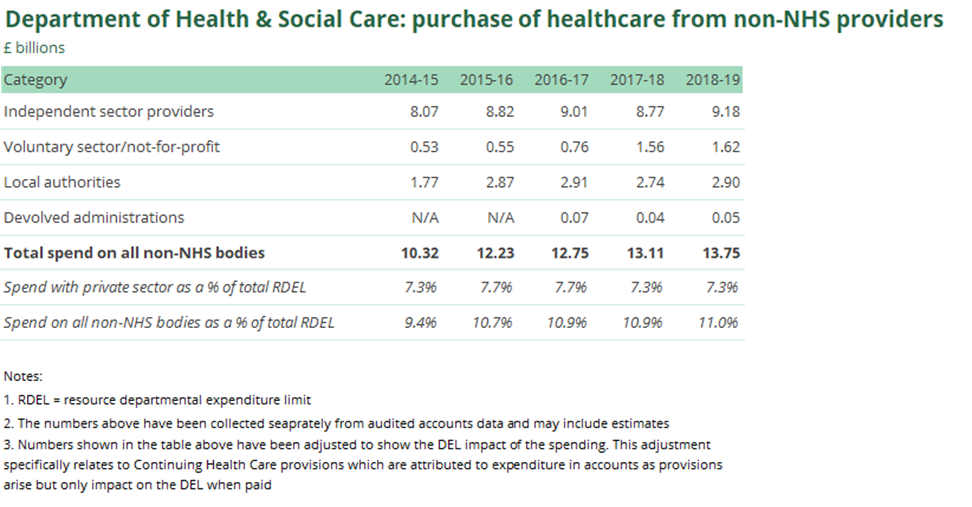

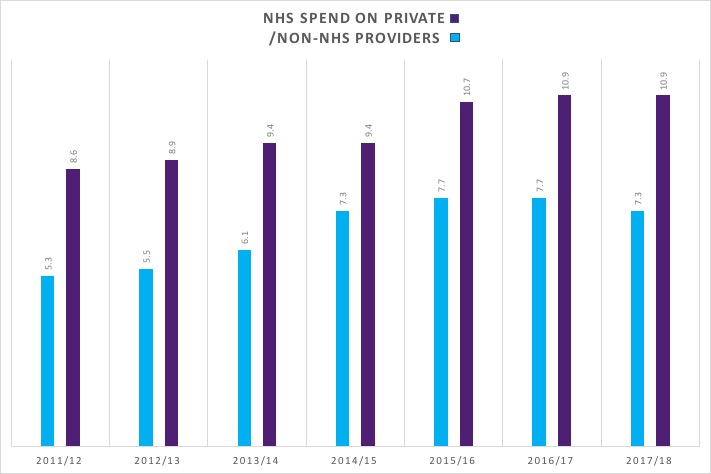

5. The amount we are spending on the private sector has been rising

The Department of Health and Social Care spent £9.7bn in 2019/20 on private providers according to its annual report. That's a rise of almost 20% from the £8.1bn in 2014-15.

Each Clinical Commissioning Group spends on average around 15% of its budget on non NHS providers but in some areas this rises to 30%. One such area is Bristol and North East Somerset where Virgin care (now HCRG Care) has a 10 year contract to run health and social care, the first of its kind.

If you find the informantion on this website useful please support our work with a donation so that we can keep providing evidence about what's happening in our NHS.

6. New trends in private sector involvement

In-sourcing

Cash-strapped hospital trusts that are charged with bringing down the waiting list for elective surgery and diagnostic procedures are turning to in-sourcing with private providers. NHS England and the Department of Health and Social Care describe insourcing as when an NHS organisation subcontracts medical services/procedures and the supplier uses the NHS organisation’s premises and equipment to deliver these services.

The idea is that these companies conduct medical procedures, such as surgery and diagnostics, in NHS premises in downtimes, primarily the weekend, when the NHS is not using the premises. The staff they employ are generally full-time NHS employees who work on their rest days.

A national framework agreement is in place with NHS Shared Business Services listing 18 companies. These companies have already gone through a competitive tendering procedure to be put on the list and can be used by trusts without additional contract tendering. The framework began back in 2018 and runs until September 2022.

The popularity of this approach has increased over the past few years and with any extra money for the NHS being funnelled into reducing the elective care waiting list, it is likely to keep on increasing. The healthcare market analysts Mansfield Advisors have noted that the NHS insourcing market is one of the fastest growing markets in private healthcare, in the 2019 financial year it was worth £44m, by FY2021 it had reached £95m, and is predicted to rise to £139m in FY2022 and £295m in FY2024.

The companies perform services for less than the NHS tariff, often at 20% less. The reason they can is that the private companies don’t have the fixed costs of their own hospital. This makes the process of insourcing highly attractive to the trusts, which are desperately trying to get more done within budget constraints.

7. Doubts over the direction of the NHS

Back in 2019, the long term plan for the NHS in England described a journey towards more integrated care, based in the community rather than hospitals, more focused on prevention and using technology to fuel improvement in the standard of care. However, in 2019, the waiting lists had reached an all-time high of 4.2 million and now the combined effect of the Covid-19 pandemic, over a decade of underfunding, a lack of workforce plans, have pushed the waiting lists up to over 7.4 million, with the prospect of them rising still further.

The removal of legislation that means NHS commissioners no longer need to advertise new contracts is virtually in place, however without significant investment in infrastructure, beds and workforce, the NHS does not have the capacity to take back the work previously carried out by the private companies. Such investment almost certainly will not happen under this government, so the NHS will continue to be forced to turn to the private sector, particularly in mental health, elective care and diagnostics. In this way the private sector becomes ever more embedded within the NHS. In February 2022, NHS England announced a ‘Delivery Plan’ to tackle the waiting list for elective care. This plan is focused on long-term reliance on the “capacity” of the private sector, which means funnelling even more NHS cash into private hospitals and private sector providers. An analysis by The Lowdown found that use of the “capacity” of the private sector is far and away the most consistent theme running through the 50-page document.

4 steps to end privatisation

-

Make the new local boards truly accountable and transparent. If the idea is to make councils, hospital and GPs share in decision making then their decisions must be open to scrutiny and challenge. The public does not support NHS privatisation and should be able to object, currently outsourcing is seldom part of a public consultation.

-

Make the NHS the preferred provider. The Health and Care Bill removes the requirement for commissioners to advertise all contracts, but it does not establish the NHS as the default provider when existing contracts come to an end. Nor does it prevent competitive tendering completely, or the extension of “framework contracts” which can award contracts without competition or tender to private companies (or other providers) from a pre-approved list.

- Build NHS capacity. Investment is needed to expand capacity of the NHS and build up its workforce so that it no longer has to rely on the private sector for capacity.

-

Act to remove the burden of PFI. The NHS is spending £2bn in inflated PFI payments. The government must explore ways to end these deals to relieve the burden on hospital finances.